Republican Policy Is The Reason Property Taxes Are So High In Texas

Back to Basics: There's truth in policy and here are some talking points that actually hold up.

Did you know that Texas has one of the highest property taxes in the nation? The 5th highest, according to The Motley Fool and Belong Home. The 4th highest, according to Bankrate. You may be thinking, “Now, wait a minute. Texas is a red state. Aren’t Republicans supposed to be better on taxes?” And you wouldn’t be wrong for thinking that. It’s what we’ve always been told. But that’s not true in Texas, and I’ll show you why.

If you’re new here, hyperlinks lead to sources.

There is a very dark element of our state that frequently pushes propaganda through their paid-off politicians and their pink slime media, that want you to believe that it’s no big deal that our property taxes are so high. It’s a tradeoff for not having income taxes. Or they say, “We have an overall lower tax burden.” Even that isn’t true.

The Texas government shifts the tax burden away from billionaires and corporations and onto working families.

Let’s start with high property taxes being a fair tradeoff for state income taxes.

Before you get your panties in a wad, no one is advocating for income taxes. Democrats hate taxes just as much as anyone. It was a Democratic majority Legislature that passed the first state ban on income taxes, and it was signed into law by Democratic Governor Ann Richards (despite Texas never having a state income tax).

But here is why it’s not a “fair tradeoff.”

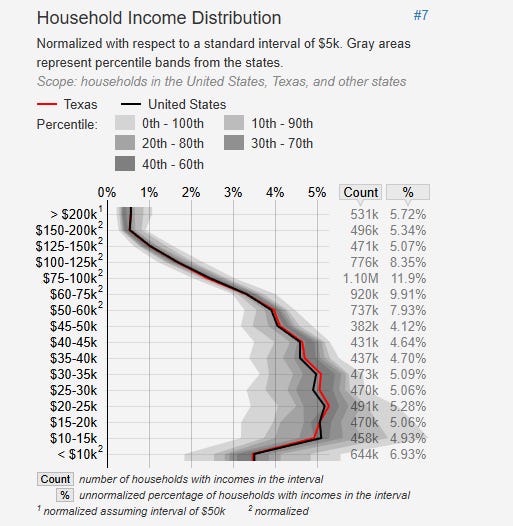

According to the Institute on Taxation and Economic Policy (ITEP), Texas has one of the most regressive tax systems in the country, meaning that the poorer you are, the higher percentage of your income you pay in taxes.

If you’re a billionaire, Texas is paradise. If you’re broke, Texas taxes you harder than California. Because there’s no income tax to balance the system, the state pushes more and more of its budget onto:

Local school districts

Counties

Cities

And they fund it through property taxes and sales taxes, the two most regressive taxes we’ve got.

So when they say “we don’t have a state income tax,” what they really mean is, “We let Exxon’s CEO and Elon Musk skate while you pay more at the pump, the register, and on your mortgage.”

But does Texas have an overall lower tax burden?

Technically, yes… if you’re wealthy. The “overall burden” is calculated as an average of ALL income groups, which masks the extreme disparity between the rich and the poor. Texas ranks as the 6th most regressive state in the country. The bottom 20% pay a much larger share of their income in taxes than the top 1%.

On paper, the “overall tax burden” may look lower, but it’s because rich people barely pay any, and working families make up the difference.

And you don’t get what you don’t pay for.

Texas doesn’t invest in:

Public schools (45th in state spending per student)

Health care (49th in access)

So Texans pay more out-of-pocket for:

Health care premiums and ER bills

Private child care, tutoring, elder care, etc.

Does a “low tax state” feel low when you’re writing a $5,000 property tax check and still paying $800 a month for health insurance?

Texas isn’t a low-burden tax state for the working class, the teachers, the nurses, or the retirees.

Why do high property taxes also matter for renters?

While homeownership in Texas is 62.6% (which is lower than the national average), renters often get overlooked in the tax debate. Studies consistently show that rents increase in tandem with rising property taxes. When those taxes go up, landlords raise the rent to cover the cost, especially in Texas, where there are no rent control laws to stop them.

In fact, the Texas state government preempts municipalities from adopting rent control unless the governor declares a housing emergency. So, if your city wanted to put rent control ordinances in place, the state prohibits them from doing so.

High property taxes also accelerate gentrification and displacement. When property values spike in a neighborhood, whether from new development, rezoning, or a flood of outside investors, taxes go up. And when taxes go up, landlords either raise the rent or sell the property entirely.

It’s especially brutal in historically Black and brown neighborhoods, where generational renters and fixed-income elders are the first to be priced out. The story’s always the same. Taxes go up, leases expire, and “renovations” move in, followed by higher-income tenants who can pay market-plus rent.

The bottom line? High property taxes aren’t just a homeowner’s issue. They raise rent, fuel displacement, and squeeze working renters every bit as hard.

So, why are property taxes in Texas so high?

Because the state refuses to pay its fair share, working people are forced to cover the difference.

Over the last two decades, the Texas Legislature, under Republican control, has steadily reduced funding for public schools, healthcare, infrastructure, and other essential services. Rather than raise revenue from the wealthy or close corporate loopholes, they’ve dumped the cost onto cities, counties, and school districts.

And how do local governments raise money? They can’t print it. They can’t tax income. So they tax property.

That’s the Republicans’ dirty little secret. Texas has high property taxes because the state abandoned its responsibilities.

When the state of Texas fails to fund public schools adequately, local school districts don’t just throw in the towel. They raise property taxes to keep the doors open. Overall, 73% of Texas school districts are underfunded.

In Texas, 9% of school funding comes from the federal level, 47% comes from the local level, and 44% comes from the state.

An Austin-American Statesman analysis of public education funding in recent years found that, “adjusted to 2024 dollars, per-student funding from state and local sources is down by 12.9%. One way that the government could reduce property taxes is by adequately funding public schools, or the “Foundation School Program (FSP).”

Increasing the state’s share (a hypothetical 25%) would mean somewhere in the math-ish range of $11 billion to $15 billion more paid by the state, which would reduce property taxes by 25%.

Now, before you get all worked up again and say Texas doesn’t have it or can’t afford it, I’d like to remind you of a few things.

Since 2021, Texas has spent over $11 billion on Operation Lone Star, despite it having no discernible impact on migration.

The 2023‑2025 biennial state budget included $6 billion earmarked for a border wall. To date, only 65 miles have been built out of 1,200 miles possible.

In 2025, lawmakers approved $350 million in taxpayer funds to recruit advanced nuclear reactors (small modular reactors).

The Legislature just approved $300 million every two years for 10 years to make “wholesome, family-friendly” movies in Texas that don’t cuss and can’t make Texas look bad. There’s another $3 billion there.

All of the above are Republicans’ political priorities over funding public schools (to name a few). Republicans have never been better for your bottom line when it comes to government spending or lowering taxes. That’s all been a myth. And where it’s most visible is in places Republicans have been in charge for a long time… like Texas.

Texas isn’t short on money. It’s short on priorities.

Expanding Medicaid in Texas would also help lower property taxes.

Accepting Medicaid expansion under the ACA (a 90/10 match) would bring in over $10 billion per year in federal funds, for just a few billion in state and local investment. That’s 10x the state’s share.

It wouldn’t raise anyone’s taxes, since we already pay this federal tax, but our money is currently being sent to other states. By rejecting expansion, Texas doesn’t save money.

Counties and hospital districts rely heavily on property taxes to cover uncompensated care for uninsured Texans. In Dallas County (2018), property owners paid an average of $535 each toward uncompensated care at Parkland Hospital. In Harris County, local leaders estimate that Medicaid expansion would cover $70 million annually in uncompensated care, money that could be used to reduce property taxes instead.

Studies by the Episcopal Health Foundation and the Perryman Group show that expanding Medicaid would yield a net positive fiscal impact for Texas, including $2.5 billion in state revenue and $2 billion for local governments.

Not to mention, expansion would reduce ER overuse, improve public health outcomes, support job creation, and stop rural hospital closures.

Not expanding Medicaid in Texas is a Republican policy that Texas Republicans have chosen. And another way that Republican policy has led to higher property taxes.

If you’re a billionaire, Texas is working just fine.

If you’re a teacher, a nurse, a renter, or a homeowner, then you’re paying for a system rigged against you.

That didn’t happen by accident.

It happened because the people in power made choices to defund schools, reject federal healthcare dollars, and hand out tax breaks to the ultra-wealthy while telling you to be grateful for your freedom.

They told you it was all just part of living in a “low-tax” state.

But what they didn’t tell you is that YOUR property taxes went up, while the billionaires’ taxes disappeared.

They didn’t tell you that local governments are raising property taxes because the state refuses to pay its bills.

They didn’t tell you that the same people complaining about government waste are the ones shoveling billions into failed border stunts, vanity walls, and wholesome anti-swearing movie subsidies.

Texas is short on priorities.

And this tax system?

It’s not broken. It’s working exactly as intended, for the people it was built to serve, the ones who pad the pockets of the politians in the majority party. And in Texas, those happen to be Republicans.

I hope this helped you see the bigger picture. And I hope it gave you the talking points you need for the next time someone parrots the line that “Republicans are better on taxes.”

Because the truth is that they’re better at blaming someone else for the hole they dug, while handing the shovel to you.

LoneStarLeft is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Follow me on Facebook, TikTok, Threads, YouTube, and Instagram.

Dear Gov. Mini-Trump.....i know how u and MAGA morons thrive in a fact free environment so sorry to intrude

this one from Animal Planets...ur grandkids watch it

"Multiple Texas Farms Shut Down After ‘Almost 100%’ Of Workforce Vanishes Overnight"

https://www.msn.com/en-us/money/companies/multiple-texas-farms-shut-down-after-almost-100-of-workforce-vanishes-overnight/ss-AA1H5GRH

Heh Mini-Don ,..,.the pidgeons have come home to roost

Long regarded as a predictor of the state of the American economy, Texas is now issuing a sobering warning. According to recent data from the Dallas Fed, retail sales activity in Texas has fallen to levels not seen since the pandemic's peak in April 2020, and consumer spending has completely collapsed in the state. In May 2025, the state's retail sales index fell 33 points to -30.5, indicating a sharp decline.